How Property Taxes Work In Texas . How property taxes are calculated in texas. With no state property tax in texas, local governments instead set tax rates and collect. Es including schools, streets, roads, police and fire protection. Master property taxes in texas: Residential property in texas is appraised annually by county appraisal districts. Texas counties and local school districts tax all nonexempt property within their jurisdictions. Texas has no state property tax. Several types of taxing units may tax your property. The appraisal districts are responsible for determining the current. Local governments set tax rates and collect property taxes to provide many local servic. You also may pay property taxes to a city and. How do texas property taxes work? The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. How do property taxes work in texas? How property taxes in texas works.

from www.quickenloans.com

The appraisal districts are responsible for determining the current. How property taxes in texas works. How do texas property taxes work? Texas has no state property tax. The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. With no state property tax in texas, local governments instead set tax rates and collect. Local governments set tax rates and collect property taxes to provide many local servic. How do property taxes work in texas? How to save money on property taxes in texas. Texas counties and local school districts tax all nonexempt property within their jurisdictions.

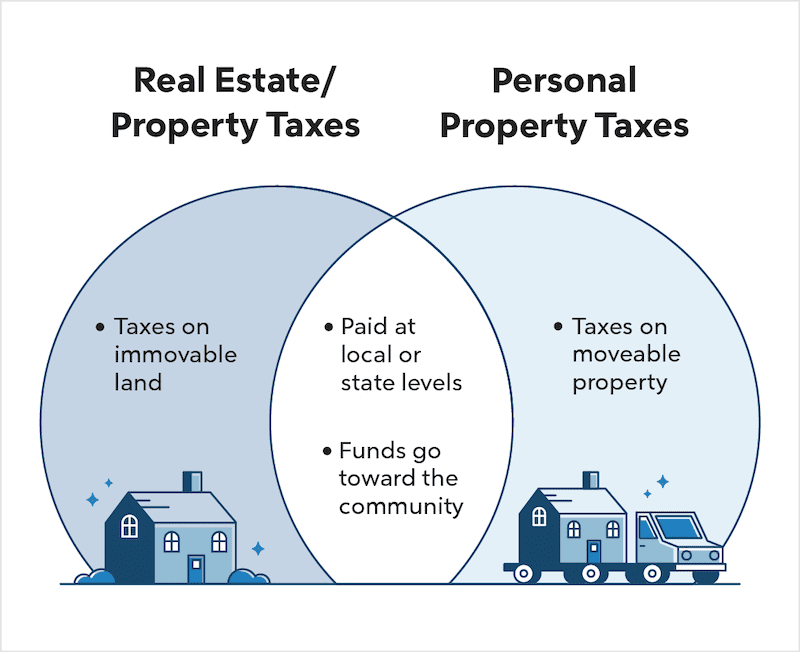

Real Estate Taxes Vs. Property Taxes Quicken Loans

How Property Taxes Work In Texas The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. You also may pay property taxes to a city and. Texas counties and local school districts tax all nonexempt property within their jurisdictions. Residential property in texas is appraised annually by county appraisal districts. How property taxes in texas works. How property taxes are calculated in texas. Texas has no state property tax. With no state property tax in texas, local governments instead set tax rates and collect. Master property taxes in texas: How to save money on property taxes in texas. How do texas property taxes work? Several types of taxing units may tax your property. The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. How do property taxes work in texas? The appraisal districts are responsible for determining the current. Local governments set tax rates and collect property taxes to provide many local servic.

From www.taxpolicycenter.org

How do state and local property taxes work? Tax Policy Center How Property Taxes Work In Texas With no state property tax in texas, local governments instead set tax rates and collect. The appraisal districts are responsible for determining the current. Residential property in texas is appraised annually by county appraisal districts. Texas counties and local school districts tax all nonexempt property within their jurisdictions. Es including schools, streets, roads, police and fire protection. How do property. How Property Taxes Work In Texas.

From www.youtube.com

How Property Taxes Work in Texas YouTube How Property Taxes Work In Texas How to save money on property taxes in texas. Master property taxes in texas: Texas has no state property tax. The appraisal districts are responsible for determining the current. Several types of taxing units may tax your property. How property taxes are calculated in texas. Residential property in texas is appraised annually by county appraisal districts. How do property taxes. How Property Taxes Work In Texas.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide How Property Taxes Work In Texas How do property taxes work in texas? Texas has no state property tax. How property taxes are calculated in texas. Master property taxes in texas: How property taxes in texas works. Residential property in texas is appraised annually by county appraisal districts. How do texas property taxes work? Es including schools, streets, roads, police and fire protection. The property tax. How Property Taxes Work In Texas.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide How Property Taxes Work In Texas How to save money on property taxes in texas. The appraisal districts are responsible for determining the current. With no state property tax in texas, local governments instead set tax rates and collect. Residential property in texas is appraised annually by county appraisal districts. Master property taxes in texas: Texas has no state property tax. Local governments set tax rates. How Property Taxes Work In Texas.

From www.mossadams.com

What You Need to Know About Property Tax in Texas How Property Taxes Work In Texas How property taxes are calculated in texas. Residential property in texas is appraised annually by county appraisal districts. You also may pay property taxes to a city and. Master property taxes in texas: Es including schools, streets, roads, police and fire protection. How to save money on property taxes in texas. How do texas property taxes work? Texas has no. How Property Taxes Work In Texas.

From www.bonnierobertsrealty.com

How Does Property Tax Work? A Guide for New Homeowners Bonnie Roberts How Property Taxes Work In Texas With no state property tax in texas, local governments instead set tax rates and collect. Texas counties and local school districts tax all nonexempt property within their jurisdictions. You also may pay property taxes to a city and. How do texas property taxes work? The property tax in texas applies to all personal property that is used to make an. How Property Taxes Work In Texas.

From activerain.com

How to Fight Your Property Taxes in Texas How Property Taxes Work In Texas Residential property in texas is appraised annually by county appraisal districts. With no state property tax in texas, local governments instead set tax rates and collect. How property taxes are calculated in texas. Texas counties and local school districts tax all nonexempt property within their jurisdictions. You also may pay property taxes to a city and. How property taxes in. How Property Taxes Work In Texas.

From www.texasrealestate.com

Property Tax Education Campaign Texas REALTORS® How Property Taxes Work In Texas Several types of taxing units may tax your property. How do texas property taxes work? How do property taxes work in texas? The appraisal districts are responsible for determining the current. Master property taxes in texas: Residential property in texas is appraised annually by county appraisal districts. Texas has no state property tax. How property taxes are calculated in texas.. How Property Taxes Work In Texas.

From byjoandco.com

How Property Taxes in Texas Work, How They Differ, & How They Affect How Property Taxes Work In Texas With no state property tax in texas, local governments instead set tax rates and collect. The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. How do property taxes work in texas? You also may pay property taxes to a city and. Several. How Property Taxes Work In Texas.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans How Property Taxes Work In Texas How to save money on property taxes in texas. Texas counties and local school districts tax all nonexempt property within their jurisdictions. With no state property tax in texas, local governments instead set tax rates and collect. Residential property in texas is appraised annually by county appraisal districts. How do texas property taxes work? How property taxes in texas works.. How Property Taxes Work In Texas.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith How Property Taxes Work In Texas Local governments set tax rates and collect property taxes to provide many local servic. Several types of taxing units may tax your property. Master property taxes in texas: The appraisal districts are responsible for determining the current. With no state property tax in texas, local governments instead set tax rates and collect. How do texas property taxes work? How property. How Property Taxes Work In Texas.

From www.honestaustin.com

What Are the Tax Rates in Texas? Texapedia How Property Taxes Work In Texas With no state property tax in texas, local governments instead set tax rates and collect. Local governments set tax rates and collect property taxes to provide many local servic. How to save money on property taxes in texas. The appraisal districts are responsible for determining the current. Texas counties and local school districts tax all nonexempt property within their jurisdictions.. How Property Taxes Work In Texas.

From thecannononline.com

Reduce Texas’ Soaring Property Taxes by Embracing Sound Budgeting How Property Taxes Work In Texas How property taxes in texas works. Texas has no state property tax. Local governments set tax rates and collect property taxes to provide many local servic. How do property taxes work in texas? The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more.. How Property Taxes Work In Texas.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation How Property Taxes Work In Texas The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. Local governments set tax rates and collect property taxes to provide many local servic. Residential property in texas is appraised annually by county appraisal districts. How to save money on property taxes in. How Property Taxes Work In Texas.

From www.texaspolicy.com

Lower Taxes, Better Texas Property Tax Relief & Reform How Property Taxes Work In Texas Texas has no state property tax. The appraisal districts are responsible for determining the current. How property taxes are calculated in texas. How to save money on property taxes in texas. With no state property tax in texas, local governments instead set tax rates and collect. The property tax in texas applies to all personal property that is used to. How Property Taxes Work In Texas.

From www.carlisletitle.com

Texas Property Taxes & Homestead Exemption Explained Carlisle Title How Property Taxes Work In Texas You also may pay property taxes to a city and. With no state property tax in texas, local governments instead set tax rates and collect. How to save money on property taxes in texas. How do texas property taxes work? Texas has no state property tax. The property tax in texas applies to all personal property that is used to. How Property Taxes Work In Texas.

From allevents.in

Property Tax 101 How Property Taxes Work & How to Protest Your How Property Taxes Work In Texas Es including schools, streets, roads, police and fire protection. How do property taxes work in texas? How do texas property taxes work? Master property taxes in texas: The property tax in texas applies to all personal property that is used to make an income, which can include automobiles, machinery, supplies, furniture, inventory, and more. How property taxes in texas works.. How Property Taxes Work In Texas.

From estradinglife.com

What is a property tax and how does it work? Estradinglife How Property Taxes Work In Texas How do property taxes work in texas? Local governments set tax rates and collect property taxes to provide many local servic. How do texas property taxes work? How property taxes in texas works. Es including schools, streets, roads, police and fire protection. How to save money on property taxes in texas. The appraisal districts are responsible for determining the current.. How Property Taxes Work In Texas.